Q&A from nearby Livingston County

Submitted by admin on Mon, 01/02/2012 - 17:28

An interview at the Livingston County News (LCN) with John Holko, who manages or owns 139 hydraulically fractured natural gas wells in Livingston County, as well as about 350 more in other places:

An interview at the Livingston County News (LCN) with John Holko, who manages or owns 139 hydraulically fractured natural gas wells in Livingston County, as well as about 350 more in other places:

[....]

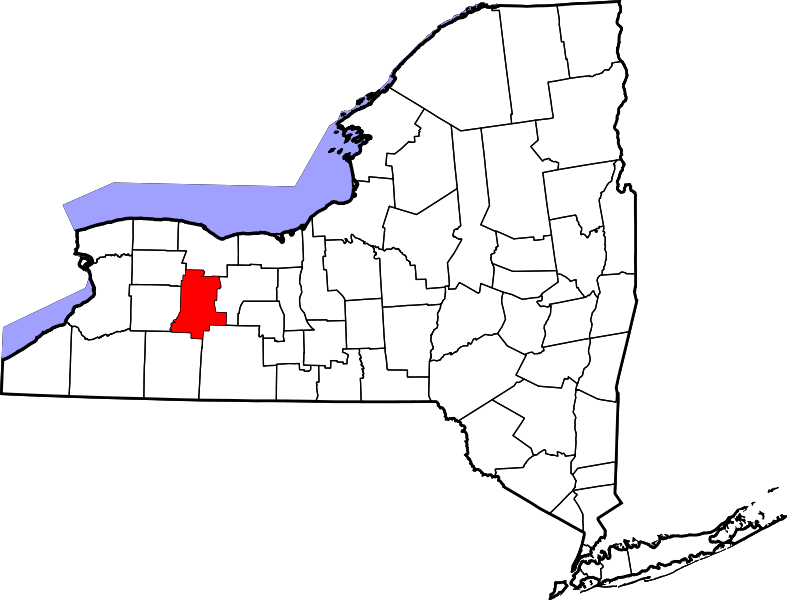

LCN: Are there any aspects of the hydrofracking opponents’ arguments which you see as having merit?Holko: Every issue anybody has with anything should be raised and discussed. The biggest problem we have is that the opponents don’t want to discuss; they want to stop us.The key to going forward in anything is to weigh the goods and bads and make sure the goods outweigh the bads. If you mitigate the negative impacts, the positive impacts make what you have decided to do worthwhile.With the opponents, there basically are three concerns that come out: The groundwater, the socio-economic impacts, and road use.For groundwater, most impacts originate on the surface. The laws of physics tend to keep things that are down deep right where they are.We do have to be concerned about minimizing the chances for spill. DEC guidelines take that into consideration and make sure everything is in tanks and pipes.LCN: Does part of the fracking fluid stay in the ground?Holko: The initial flowback of fluid is about 20 percent of what was pumped down. What comes back will be reprocessed and reused. The other 80 percent comes back later in the life of the well, or stays down there.It’s not coming up.There are rock formations down there which contain very bad water to begin with — and it’s not coming up.Processes have been developed to extract the heavy metals and other undesirable things that come back up with the flowback fluid. Industry has been handling these chemicals for many years. We know how to treat the materials to make them inert and safe.The fluid will be regulated, monitored and controlled and will not be contaminating the groundwater.LCN: In the movie ‘Gasland,’ we see documentation of fluid residues getting into people’s home water systems, to great ill effect. Could something like that happen here?Holko: Josh Fox’s movie is entertaining, but as somebody who has been drilling oil and gas wells for 30 years, I find parts of it so far-fetched as to be hard to believe. Still, I can see how it can scare people.In Pavilion, Wyoming the fresh water aquifer and the coal zone where the natural gas is coming from are almost one and the same. In New York, we will not be fracking in fresh water aquifers.LCN: Some of the maps we’ve seen show a grid of well heads filling the landscape, with very few areas free of the noise from running pressurizers.Holko: That’s not going to happen. Where we may drill is limited by the presence of flood plains, distance from highways, waterways etc.When we do drill, we can reach the equivalent of two square miles of land from a single well head. A temporary pad uses about five or six acres, shrinking to two acres in the production phase.There are very few uses of natural resources in this world which have such a small ratio of impact area to use area. We are disturbing two acres and recovering a resource from 1,280 acres.And this is one of the few industries which directly supports those affected. There are bonus payments and royalties to the landowner, as well as taxes paid on the production value of the property. All that money goes right to the community which is affected.LCN: Isn’t this similar to the wealth produced here at the salt mine?Holko: Natural gas benefits the community even more. There is no tax on extracted salt. There is a tax on the extracted gas.In addition, landowners get cash back as the gas is recovered — up to 12-to-15 percent of the total. That doesn’t happen for the landowner when salt is recovered under his property.LCN: Exactly how is a gas well taxed?Holko: The producer gets two tax bills every year, just as if he owned a home: one in January and one in September. Title 5, Article 5 of the Real Property Tax Law specifies that the production coming out of the well creates the value of the [surface] property, as calculated over a five year average. Awell which produces a dollar value in natural gas each year is taxed the same amount as a home of that value.A Pennsylvania well, if it were here, might be paying $300,000 a year. Taxes will pretty much track the market commodity value.LCN: How is gas transported from the well head?Holko: By a pipeline from the well head to a central facility. By the way, New York’s natural gas is dry — which means you can take it directly from the well and burn it in your home . It has no contaminants at all. A lot of landowners with wells on their property have a connection to their homes and get free gas.LCN: How wide are the easements for these pipelines?Holko: Most easements will be 30 foot wide when the pipeline is under construction, then end up 10 foot wide for maintenance. Pipe diameter can range from 6 inches to 24 inches — buried, as required in New York State, to ‘below plough’ depth. In some cases, higher pressure lines need to be buried deeper.LCN: Do you have eminent domain to lay pipes where you want?Holko: No. Everything has to be negotiated with the landowners — and the Public Service Commission will dictate routes. We tend to use already impacted areas. Lines are installed where pipelines already have been. Gathering lines from wells may be right next to distribution lines from utilities.LCN: Do you pay a separate property tax on the distribution pipelines?Holko: No. Tax on the pipe to first sell — the first point where we receive revenue — is included in the unit of production. If a separate company were to come in and build the gathering lines, they would be taxed separately.LCN: Will the fact that we will be buying natural gas produced closer to home give us a price break?Holko: Yes. Every commodity has its value as itself and its value after getting it to market. The closer the commodity can be to the market, the lower the separation between the two values.New York natural gas used in New York will be a great resource. Energy costs in New York have been historically high because we have always been very far from the source.LCN: What will happen to the waste products after you refine fracking fluid for reuse?Holko: The aquifer remediation facility in Cuylerville has developed a process to handle and remove the various [undesirable] materials that are in the fluids they bring up. They are one of the companies interested in working with the oil and gas producers in recycling the fracking fluids.And Lake County Frack Water Specialists of Lakeville have created an extraction process to remove heavy metals — barium and strontium — which show up in the fluid. At this point it is simply an inert byproduct, but it would be valuable if obtained in quantity.LCN: Will these solid waste products be hazardous or costly to dispose of?Holko: What is waste material to one person is valuable to another. Waste is only waste to the person who doesn’t want it. Just about everything that is refined out of the fluids that come out of wells has a value.If we can recover some of the heavy metals — lithium and manganese — from waste refining processes, we could make batteries without being dependent on China.LCN: Will the fluids brought up from wells contain any naturally occurring radioactive elements in hazardous concentrations?Holko: No. Levels of radiation will remain at background-or-below levels. A waste management firm has taken drill cuttings from the Marcellus Shale for landfill disposal. The single incident of a high radiological sampling turned out to be from medical radioactive tracers the truck driver had taken for a heart test.Marcellus shale comes to the surface in Marcellus where people drink well water from the shale each and every day with no harmful effects. Radioactivity is in the ground and can be moved around, but it can’t be concentrated. It is naturally occurring, and ends up dissipating naturally.LCN: What about the criticism that the jobs hydrofracking will bring will be taken by outside specialists, not by the folks who are here now?Holko: When something comes in, it will come in as a whole, but as it develops, local people will become involved and gain understanding. SUNY Geneseo geology graduate perhaps, instead of moving to Texas, might be able to find work in New York and Pennsylvania.Over the past five years in Pennsylvania, local employment in gas drilling went from zero to almost three percent of the working population.And is it such a bad thing if someone moves from Louisiana and buys a house in Geneseo?Economic growth has to start somewhere. That’s how the evolution of industry works.LCN: In your opinion, how are the opponents mistaken?Holko: So far this process has been poorly understood, but it’s a tremendous opportunity.The reality is we are not going to work New York out of its fiscal problems building wineries around the Finger Lakes. We need industry.The other side has created a fear factor. But you can’t look at everything new as bad. Instead look at it as opportunity.If you do have environmental concerns, you create the focus. New York has a regulatory structure second to none. The contrast with other states is like night and day. The stuff that’s been done in Wyoming and North Dakota isn’t going to happen in New York.The DEC will tell you that since its implementation of drilling and cementing practices in the 1980s, there has been no water contamination from hydraulic fracturing and drilling.Under the new SGEIS, there will be no flowback which is not contained within a tank or a pipe. This industry will be safe and controlled.I’ve done pre- and post-drilling water sampling all over New York and Pennsylvania. The three biggest issues I find, outside of cases where someone just always has had naturally occurring bad water — are pollution from septic tanks, agriculture fertilizer spills, and drainage off of farm waste.The amount of water the industry will be using in total is minuscule in comparison to the amount of water that flows through just one New York State river. Mother nature does its own cleansing — and contaminating — on scales much greater than the industry would be capable of.We have the knowledge to prevent just about any environmental issue — and we have an opportunity which I believe is once in a lifetime.People really have bigger problems they should be focusing on: their schools’ financing, for example. That should be more of a concern than a well, which if it comes, might pay $300,000 a year in property tax.LCN: When hydraulic fracturing is permitted, are we likely to see an abundance of wells in Livingston County?Holko: Truthfully, the likelihood of this type of drilling being above the southern point of Livingston County is pretty limited. If it comes to Livingston County at all it will be the southern edge, and it’s definitely not going to start there.The New York counties which are the focus areas are Chemung, Tioga and Broome. The typical industry map doesn’t have Livingston County on it.Could there be Utica Shale development even deeper? Maybe, but it’s not going to happen today.LCN: What about the concern that industry trucks will ruin our roads?Holko: The road supervisor for Bradford County, Pa. reported that the industry just spent $353 million building roads in his county. In contrast, the most the local and state government have spent is $60 million, and they take three years to start a project.LCN: It would seem there is at least some gas or oil potential almost everywhere below western New York.Holko: There are petroleum products under most of the United States. It’s a matter of finding, drilling and recovering.LCN: Share your thoughts on the positive social aspects of well drilling.Holko: There is the drilling phase and, yes, there are more people and there is more truck traffic. But if you’re running the local gas station and convenience store, that’s hardly a negative. Your cash register is ringing.There use to be a lot of ‘for sale’ signs along Route 6 in Pennsylvania. You can’t find one today, but they’re still everywhere in New York.You can’t have good things happen if you don’t create wealth.I grew up in Johnstown, Pa. when it was still mills and coal mines. It may have been a bit smokier, but it was a lot busier and a lot nicer. Everybody was friendly. Everybody cared. When good things are happening, everybody is in an upbeat mood.

- Log in to post comments