The economics of gas drilling

By Tom Reynolds

Getting the straight, untwisted facts concerning any aspect of fracking is very difficult. However, the anti-fracking element seems particularly adept at emotional (rather than factual) presentations that are half-truths. Since my background is finance, I was particularly interested in Jannette Barth’s study on the economic impact of gas drilling in the Marcellus Shale. Both in her study and at anti-fracking meetings Barth states, “Studies used to support the claim that drilling will bring economic benefits to New York are either biased, dated, (or) seriously flawed.”

Then, she produces a study that is “biased, dated, and seriously flawed.”

-

Barth compares gas’s economic impact in NY’s top 10 gas-producing counties to neighboring NON-gas-producing counties. She unequivocally concludes that ‘gas counties’ are not doing better economically than neighboring counties. But gas jobs and payroll in “gas counties” make up less than 4/10s of 1% (.004) of the counties’ jobs & payroll. Her conclusion can certainly be described as seriously flawed, based on the insignificant difference in gas-related jobs and payroll between the counties.

-

Barth dismisses gas drilling’s economic multiplier of 1.4, i.e., every $1 of payroll has a $1.40 impact on the local economy. She concludes that, “On economic impact alone, gas drilling should not necessarily be encouraged…it would appear to make more sense to encourage an alternative industry that would provide a greater economic impact…such as tourism.” But Barth never actually gives an economic multiplier for tourism. The highest I found was 1.67.

-

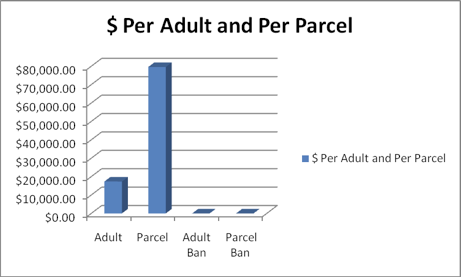

Barth ignores the fact that there has to be at least two parts to a multiplication operation, one being the base—in this case, the average salary to be multiplied. Since Barth’s paper was published, the Ithaca Journal has published articles on two studies comparing average salaries. Hospitality (tourism) has average salaries of about $20,000 while all industries other than agriculture were over $40,000. To just equal the impact of gas, tourism would need an economic multiplier of 2.8!

-

On rural environments, Barth states, “Unfortunately, it is difficult to assign precise monetary values to aesthetic benefits.” Of course, it is difficult to value “aesthetics,” primarily because someone else usually owns it! But the anti-gassers don’t want someone else’s property rights to interfere with their aesthetics.

Throughout, Barth uses possibilities in a way that can best be described as “it’s a fact that it’s a possibility.” A few examples:

- Barth states, “It is possible that local land owners who get rich from natural gas will move to Florida or other points south, taking their new found wealth with them.” She ignores the fact that it’s also possible they might not move! And even if half moved, the half that stayed would be pumping NEW MONEY into the local and state economies.

- Barth also states that due to negative economic issues, “It is quite possible that…existing homeowners may be driven out.” That they might also stay, due to positive economic issues, is never mentioned.

- “To some extent, gas drilling and other industries (tourism, sport fishing and hunting) may be mutually exclusive.” Or maybe not?

- “Far fewer retirees will choose to settle and second home owners would certainly be vastly reduced in numbers.” Based on what study of occurrences that have not yet occurred?

Towards the end of her paper, Barth quotes a study done by Headwater Economics, which compared western U.S. counties that focused on fossil fuel extraction as an economic development strategy to counties that did not focus on such industries. Barth summarizes one of Headwater’s conclusions as, “While energy-focused counties race forward and then falter, non-energy peer counties continue to grow steadily.”

But other Headwater studies, not quoted by Barth, give a much more complete description of their research. For example, “Energy producing states outperformed their peers fiscally at the start of the recession, but ultimately the decline in fossil fuel prices and reduced revenue exposed (them) to the impacts of the recession.” Headwater also said, “Predominantly rural areas with high levels of drilling and limited economic diversity may be the most overwhelmed by the buildup phase of the energy boom, but also are the places that ultimately may see the greatest long term fiscal gain from energy development.” Further, Headwater states, “The tax revenue from fossil fuel extraction is the longest lasting legacy of fossil fuel development…it continues to accrue.” On green energy, Headwater praises, “Colorado made energy revenue funding available for regional clean energy initiatives…the funding helped launch an effort that has grown businesses and jobs and has funded clean energy infrastructure.”

Lastly, one of the four studies that Barth trashes is one done at Penn State. Of it she says, “An intelligent lawmaker should not take this study seriously.” After having read her study, I would suggest that anyone with at least a room temperature IQ should not take her paper seriously.

- Log in to post comments